In today’s dynamic global business environment, strategic risk management has never been more critical. Boards of directors are increasingly recognizing their pivotal role in navigating uncertainties, managing risk and seizing opportunities. This article explores how enterprise risk management (ERM) empowers boards to take proactive steps toward comprehensive risk coverage and better governance.

Understanding Strategic Risks: Evolving Risk Management

Traditionally, risk management has centered on financial and operational concerns. However, the modern landscape demands a more comprehensive approach. Strategic risks—ranging from market fluctuations to emerging technologies—now require focused and forward-thinking responses. For instance, emerging technologies like artificial intelligence and automation can fundamentally reshape industry dynamics, potentially rendering existing business models obsolete or creating new cybersecurity vulnerabilities that could compromise critical operations. These technological shifts can rapidly transform competitive advantages into liabilities, making traditional risk assessment frameworks insufficient for modern challenges.

An effective ERM approach helps boards go beyond traditional frameworks by aligning risk management with strategic objectives, while simultaneously informing the development of those objectives themselves. By incorporating risk insights during strategic planning, boards can better evaluate opportunities and threats before setting organizational direction. This dual role of ERM—both shaping and supporting strategy—enables boards to navigate uncertainties and capitalize on opportunities while managing possible drawbacks.

Exploring the Four Quadrants of ERM

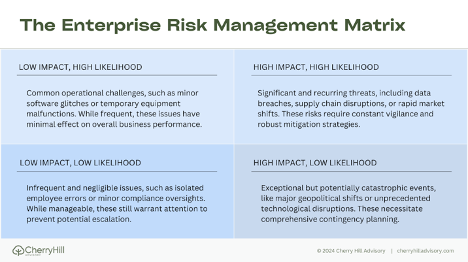

Understanding how to prioritize and respond to various risks is a fundamental challenge for any board. To address this complexity, risk management professionals have developed structured approaches that help organizations categorize and evaluate different types of risks they face. One particularly useful tool is the quadrant framework, which helps boards visualize and prioritize risks based on two critical factors: their potential impact on the organization and their likelihood of occurrence. This systematic approach enables boards to allocate resources and attention more effectively, ensuring that the most critical risks receive appropriate focus while maintaining awareness of other potential challenges.

ERM frameworks often categorizes risks into four quadrants based on impact and likelihood:

Looking at the upper left quadrant, organizations regularly face low-impact, high-likelihood risks such as routine equipment maintenance. While these issues occur frequently, their minimal impact means they can be managed through efficient processes without demanding significant resources. Moving to the upper right quadrant, we encounter the most critical category: high-impact, high-likelihood risks, exemplified by persistent cybersecurity threats. These risks demand immediate attention and substantial resource allocation, requiring comprehensive mitigation strategies to protect the organization's core interests.

The lower left quadrant encompasses low-impact, low-likelihood events, such as minor clerical errors. While these issues warrant basic safeguards and general awareness, they typically require minimal resource investment. Finally, the lower right quadrant represents high-impact, low-likelihood events—think major natural disasters or unprecedented technological disruptions. Though rare, these potentially catastrophic events necessitate robust contingency planning and often benefit from risk transfer mechanisms like insurance coverage.

This systematic approach to categorizing risks enables boards to make more informed decisions about resource allocation and risk management priorities, ensuring that attention and resources align with both the potential impact and probability of various risks facing the organization.

Boards can leverage this model to evaluate which risks demand the most attention and resources, ensuring comprehensive coverage and better alignment with strategic goals. In practice, this means regularly mapping identified risks onto the matrix through collaborative assessment sessions, where board members and senior management can collectively evaluate each risk's potential impact and likelihood. High-impact, high-likelihood risks in the upper right quadrant should command the majority of the board's attention and risk management resources. However, boards must also maintain a balanced approach by establishing monitoring systems for high-frequency, low-impact risks, while developing contingency plans for those rare but potentially catastrophic events. This dynamic process should be revisited quarterly or as market conditions change, allowing boards to adjust their risk management priorities and resource allocation accordingly. The matrix thus serves as both a strategic planning tool and an ongoing governance framework, helping boards maintain a comprehensive view of their risk landscape while making informed decisions about where to focus their oversight efforts.

Governance, Risk Management, and Compliance (GRC)

GRC principles are essential in today’s risk environment. However, many directors still focus primarily on financial or credit risks. Boards must expand their risk lens to include emerging challenges such as:

- Technological risk: The rapid pace of technological change presents both opportunities and vulnerabilities. Boards should ask how new technologies may disrupt their industries and how to mitigate potential threats. For instance, the widespread adoption of AI tools like Microsoft's Copilot for enterprise operations presents a dual challenge: organizations that fail to integrate such technologies risk falling behind competitors in operational efficiency, while those that adopt them must manage new risks around data security, workforce adaptation, and potential errors in AI-driven decision-making. Similarly, the emergence of large language models is reshaping customer service, content creation, and knowledge work, forcing boards to consider both the competitive necessity of adoption and the associated risks of implementation.

- Competitive risk: Market shifts driven by competitors can erode market share or make certain products obsolete, particularly as technological innovation and competitive advantage become increasingly intertwined. For instance, competitors who successfully leverage artificial intelligence for personalized customer experiences or blockchain for supply chain optimization can rapidly capture market share and redefine industry standards. This technological-competitive nexus means that falling behind in digital transformation isn't merely a technological risk—it can swiftly become an existential competitive threat. Organizations must therefore view competitive monitoring through a dual lens, tracking not only traditional market movements but also how competitors' technological innovations might reshape the competitive landscape. Monitoring these interconnected competitive trends is vital for sustained growth and market relevance.

- Market risk: Boards need to track broader economic trends, from consumer behavior shifts to geopolitical instability, that could affect business operations. Unlike in the past, when market risks were largely confined to traditional economic indicators and regional political events, today's interconnected global economy means that distant events can rapidly cascade across markets and industries. A semiconductor shortage in Asia, for instance, can quickly disrupt manufacturing in Europe, while social media trends can transform consumer preferences overnight. The accelerated pace of information flow and market reaction means boards must expand their risk monitoring beyond their immediate industry or geographic region, maintaining awareness of global supply chains, social movements, and technological disruptions that could reshape entire market dynamics. This broader, more dynamic approach to market risk assessment has become essential in an era where traditional industry boundaries are increasingly fluid and distant market forces can create immediate local impacts.

Expanding awareness and fostering open discussions on these risks will enable boards to ask better questions and steer the organization with greater foresight.

Facilitating Proper Risk Coverage: Key Board Actions

Having explored the complex landscape of enterprise risk management and its evolving challenges, we now turn to the crucial question facing every director: "How do we put this knowledge into action?" The following strategic actions represent essential steps that boards must take to fulfill their risk oversight responsibilities effectively. These recommendations aren't merely theoretical—they are practical, implementable measures that can significantly enhance a board's ability to protect and create value through proper risk management. Directors who successfully implement these actions will be better positioned to guide their organizations through an increasingly complex risk landscape while seizing opportunities for sustainable growth.

- Cultivate a Risk-Aware and Opportunity-Focused Culture: Boards should foster a culture where employees not only understand and actively identify potential risks but also recognize opportunities that emerge from changing conditions. This involves open communication about the organization's risk appetite and strategic vision, encouraging employees at all levels to report both potential risks and opportunities. Such a balanced approach ensures that risk awareness doesn't stifle innovation but rather supports informed decision-making that can turn market challenges into competitive advantages.

- Engage in Strategic Risk Discussions: Boards should facilitate ongoing, organization-wide discussions about strategic risks. Diverse perspectives are key—inviting input from different departments and even external experts provides a more comprehensive understanding of potential threats and opportunities.

- Leverage Internal Audit as a Strategic Partner: While internal audit teams traditionally focused on financial and operational controls, their role in modern ERM extends far beyond these conventional boundaries. Boards should work closely with internal audit to evaluate the organization's entire risk ecosystem—from emerging technological threats to market disruption risks. This expanded partnership enables internal audit to provide valuable insights into how various risks interconnect across the organization, assess the effectiveness of risk responses in all four quadrants of the risk matrix, and help identify strategic opportunities that might emerge from risk mitigation efforts. When properly leveraged, internal audit can help boards bridge the gap between traditional risk controls and the broader strategic risk landscape, ensuring that ERM efforts align with both protective and value-creating objectives.

- Embed Risk in Performance Metrics: Risk management should be built into performance reviews and incentives. Aligning these metrics with strategic objectives ensures that employees at all levels contribute to the organization’s overall risk resilience.

- Use Technology to Enhance Risk Management: Advanced technology, such as machine learning and data analytics, can provide boards with valuable insights into emerging risks, but technology alone isn't a complete solution. While these tools can process vast amounts of data and identify patterns, they require human expertise to establish meaningful parameters and interpret results effectively. The human element is particularly crucial in identifying emergent risks arising from technology convergence and adoption—risks that might not fit historical patterns. Boards must ensure that risk detection algorithms are guided by sound theoretical frameworks and industry expertise, as machine learning systems are only as effective as the human-designed criteria used to train them. This balanced approach, combining technological capabilities with human insight, helps organizations avoid potential blind spots in their risk detection and assessment processes.

- Conduct Regular Risk and Opportunity Assessments: Periodic reviews of the risk landscape serve a dual purpose: they keep the board informed of emerging risks while also revealing potential strategic opportunities. These assessments shouldn't merely align with existing strategic objectives—they should actively inform and reshape those objectives as new market dynamics emerge. For instance, an assessment that identifies emerging technological risks might simultaneously highlight opportunities for digital transformation that warrant a strategic pivot. This dynamic approach ensures that risk assessment becomes a catalyst for strategic evolution, enabling boards to adapt organizational direction in response to both challenges and opportunities in the changing business environment.

- Ensure Board Diversity: A diverse board brings critical expertise in three key areas essential for modern risk oversight: technological expertise, operational risk management experience, and strategic planning backgrounds. These diverse perspectives enable richer problem-solving approaches to complex risks. For example, when facing a major market disruption, directors with different thinking styles and experiences contribute unique insights: analytically minded directors might focus on data patterns and quantitative risk metrics, while directors with entrepreneurial backgrounds might identify hidden opportunities within the threat, and those with crisis management experience might challenge assumptions about response timing and resource allocation. This cognitive diversity helps boards avoid collective blind spots, challenges conventional thinking, and generates more innovative risk responses. When combined with varied industry experiences, these different thought processes ensure risks are examined from multiple angles – from immediate operational impacts to long-term strategic implications – leading to more robust and comprehensive risk management strategies.

Effectively managing strategic risks through ERM is essential for boards facing today’s dynamic landscape. By going beyond traditional risk management approaches and embracing ERM, boards can lead their organizations to achieve resilience and with foresight navigate into an ever-changing future. Boards must cultivate risk-aware cultures, facilitate ongoing risk discussions, embed risk in performance metrics, and ensure diversity in their ranks. Through these actions, boards can turn strategic risk management into a powerful tool for sustained success even in times of change and complexity.

ABOUT THE AUTHOR

MIKE LEVY

Mike Levy is CEO & Managing Principal at Cherry Hill Advisory. Cherry Hill Advisory is a leading global risk advisory firm dedicated to providing comprehensive internal audit and transformation services. Our expertise spans Operational Auditing, Emerging Risk Management, Risk Assessment, Financial Compliance, Business Transformation, and Quality Assessment.